Accidents, unfortunately, are an unavoidable reality on Singapore’s busy roads. With the high volume of vehicles navigating the city-state’s streets and expressways, fender benders and more serious collisions are bound to happen. When they do, it’s crucial to understand how liability is determined and how insurance claims are processed. This is where the Barometer of Liability Agreement (BOLA) comes into play.

The Barometer of Liability Agreement (BOLA) is a pivotal agreement among major insurance companies in Singapore that aims to standardize and streamline the process of determining car accident liability in Singapore. This agreement, developed and maintained by the General Insurance Association (GIA), provides a clear framework for assessing the percentage of responsibility each party bears in an accident, which in turn affects insurance payouts, No-Claim Discounts (NCDs), and ultimately, the overall claims experience.

BOLA is a guide used by insurers in Singapore to determine how much each party is responsible for in an accident. It is is intended to speed up the claims process, but it does not affect the right to contest liability under the law.

Understanding BOLA Singapore is essential for anyone driving in Singapore, whether you’re a seasoned driver or a new one. It empowers you to navigate the aftermath of an accident more smoothly, understand your rights and responsibilities, and ensure you receive a fair settlement when dealing with motor insurance claims in Singapore.

In this detailed article, we’ll explore the complexities of BOLA, learning its mechanics, benefits, limitations, and its impact on your insurance claims.

What is the Barometer of Liability Agreement (BOLA)?

The Barometer of Liability Agreement (BOLA) is essentially a set of guidelines that major insurance companies in Singapore have agreed upon to standardize the process of determining liability in motor accidents. It provides a clear and consistent framework for assessing fault in various common accident scenarios, making claim settlements faster, more efficient, and more transparent. This framework helps streamline the motor claims framework (MCF) in Singapore.

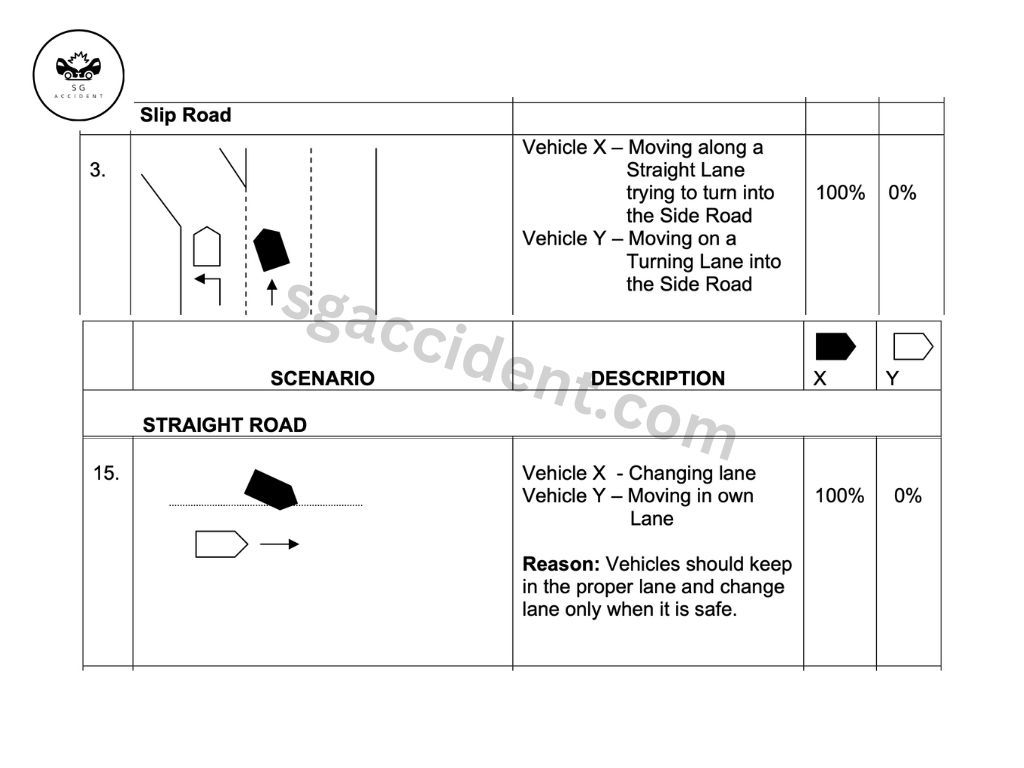

BOLA covers a wide spectrum of accident scenarios, from the most common ones like rear-end collisions and lane change accidents to more complex situations such as accidents at junctions, roundabouts, and parking areas. By providing pre-determined liability percentages for these typical scenarios, BOLA enables insurers to quickly assess fault and process claims, often without the need for extensive investigations or protracted disputes, which can be especially helpful when dealing with straightforward cases.

It’s important to note that BOLA is not a legally binding document. It’s a set of guidelines designed to simplify and expedite the claims process. While insurers typically adhere to BOLA in assessing liability, it doesn’t replace the need for a thorough investigation, especially in cases with conflicting accounts or contributing factors.

How BOLA Works in Singapore

Standardized Scenarios

BOLA outlines various common accident scenarios, such as rear-end collisions, lane changes, turning at junctions, and merging onto expressways. For each scenario, it provides a general guideline for apportioning liability between the involved parties.

Pre-determined Percentages

BOLA assigns pre-determined liability percentages for each scenario, making the assessment process more objective and consistent. For example, in a typical rear-end collision, the driver of the rear vehicle is usually deemed 100% liable.

Flexibility for Unique Circumstances

While BOLA provides a framework, it also allows for flexibility to account for unique circumstances or contributing factors. For instance, if the lead vehicle in a rear-end collision braked suddenly without a valid reason, the liability percentage might be adjusted to reflect the contributing negligence of the lead driver.

Here are some steps to take in the event of a motor claim in Singapore:- Exchange details and note vehicle numbers

- Call your insurer’s hotline for a tow truck, if necessary

- Report the accident and take your vehicle to an authorized workshop or approved reporting center within 24 hours

How is BOLA used to determine liability in accident claims?

When a motor accident occurs in Singapore, it’s crucial to follow the proper procedures. This includes:

Ensuring Safety

The first priority is to ensure the safety of everyone involved. If anyone is injured, call for an ambulance immediately. Move vehicles to a safe location if possible, and warn oncoming traffic to prevent further accidents.

Exchanging Information

Exchange contact and insurance information with the other party involved. This includes names, contact numbers, vehicle registration numbers, and insurance policy details.

Documenting the Scene

Take photos or videos of the accident scene, including the positions of the vehicles, any damage, and relevant road conditions or signage.

Filing a Police Report

File an accident report with the police, especially if there are injuries or significant damage. This is a legal requirement in Singapore and is crucial for insurance claims.

Once the necessary information is gathered, the involved parties file claims with their respective insurance companies. The insurers then use BOLA as a starting point to determine car accident liability in Singapore. They meticulously assess the accident circumstances, gather evidence such as police reports, witness statements, and any available dashcam footage, and refer to the BOLA guidelines to determine the initial percentage of fault for each party involved.

How is Liability Determined in a Car Accident in Singapore?

Initial Assessment using BOLA – Insurers begin by applying the BOLA guidelines to the specific accident scenario. This provides an initial assessment of liability based on the pre-determined percentages.

Evidence Gathering and Review – Insurers gather and review all available evidence, including police reports, witness statements, dashcam footage, and vehicle damage reports.

Consideration of Contributing Factors – Insurers consider any contributing factors that might have influenced the accident, such as road conditions, weather, visibility, and the actions of other road users.

Final Liability Determination – Based on the evidence and assessment of contributing factors, insurers determine the final liability apportionment. This might involve adjusting the initial BOLA percentages if the evidence warrants it.

What are the implications of BOLA for my No-Claim Discount (NCD)?

Your No-Claim Discount (NCD) is a valuable benefit that rewards safe driving habits. It allows you to accumulate discounts on your car insurance premiums for each year you drive without making a claim. In Singapore, NCD can range from 0% for new drivers to a maximum of 50% for drivers with five or more consecutive claim-free years.

However, an accident, even a minor one, can affect your NCD, and BOLA plays a role in determining the extent of this impact. The percentage of liability determined through BOLA directly influences how your NCD is adjusted.

Full Liability (100%)

If you are found to be fully liable for an accident, your NCD will typically be reduced, and you’ll lose some of the accumulated discounts. The extent of the reduction depends on your insurer’s specific policy and your current NCD level. For example, if you have a 50% NCD and are found fully liable for an accident, your NCD might be reduced to 20%.

Partial Liability

If you are found to be partially liable for an accident, your NCD may be partially reduced or may remain intact, depending on the percentage of liability and your insurer’s policy. For instance, if you have a 50% NCD and are found 20% liable for an accident, your NCD might be reduced to 40% or might remain at 50%.

No Liability (0%)

If you are not at all liable for an accident, your NCD should be protected, and you should not lose any accumulated discounts.

How does BOLA affect NCD in Singapore?

NCD Protection – Some insurers offer NCD protection as an add-on to your car insurance policy. This allows you to make a certain number of claims within a policy period without affecting your NCD.

Private Settlement – In some cases, if the accident is minor and both parties agree, you might be able to settle the matter privately without involving insurance companies. This can help protect your NCD. However, it’s important to exercise caution with private settlements and ensure you have a clear agreement with the other party.

Understanding the link between BOLA, liability, and your NCD is crucial for all drivers in Singapore. It emphasizes the importance of safe driving practices and highlights the potential financial consequences of accidents on your insurance premiums. By driving defensively and responsibly, you can not only protect yourself and others on the road but also safeguard your valuable NCD.

What are the benefits of using BOLA in accident claims?

BOLA offers numerous benefits to both insurers and claimants, making it a valuable tool in the motor insurance landscape in Singapore:

Faster Claims Processing

One of the primary advantages of BOLA is that it significantly expedites the claims process. By providing a clear and standardized framework for liability assessment, it reduces the need for lengthy investigations and disputes, allowing insurers to process claims more quickly and efficiently. This translates to faster settlements for claimants, enabling them to get back on their feet sooner.

Reduced Disputes

BOLA helps minimize disagreements and disputes between parties involved in an accident by providing a common and objective approach to determining fault. This reduces the likelihood of protracted negotiations or legal battles, saving time, money, and stress for everyone involved.

Increased Transparency

BOLA promotes transparency in the BOLA claims process by providing a clear set of guidelines that are readily accessible to both insurers and claimants. This allows claimants to understand how liability is assessed and how their settlement is calculated, fostering trust and confidence in the insurance process. This transparency is further enhanced by the Motor Claims Framework (MCF), which encourages open communication and information sharing between insurers and claimants.

Consistency and Fairness

By standardizing liability assessment, BOLA ensures a more consistent and fair approach to handling motor accident claims. This helps prevent discrepancies and biases in claim settlements, ensuring that all parties are treated equitably.

Improved Efficiency for Insurers

BOLA allows insurers to handle a higher volume of claims more efficiently, reducing administrative costs and improving overall customer satisfaction. This efficiency also benefits claimants, as it can lead to faster processing times and quicker resolution of claims.

Encourages Amicable Settlements

By providing a clear framework for liability, BOLA encourages private settlements between parties involved in an accident. This can be a faster and less stressful way to resolve claims, especially for minor accidents where both parties agree on the fault.

What are the limitations of BOLA?

While BOLA is a valuable tool with numerous benefits, it’s important to be aware of its limitations:

Not Applicable in All Cases

BOLA primarily covers common accident scenarios. In complex or unusual cases, such as those involving multiple vehicles, unclear fault, or contributing factors like road defects, BOLA may not be applicable. These situations may require more detailed investigation, expert opinions, or even legal intervention to determine liability accurately.

- Example: Imagine an accident involving three vehicles at a complex intersection with unclear witness accounts and conflicting evidence. In such a case, simply applying the standard BOLA guidelines might not be sufficient to determine liability accurately. A more thorough investigation might be needed to consider all contributing factors and arrive at a fair assessment.

Doesn’t Replace Legal Advice

While BOLA can guide liability assessment, it’s not a substitute for professional legal advice, especially in cases with significant disputes, potential legal implications, or injuries involved. If you’re unsure about your rights or responsibilities after an accident, it’s always advisable to consult with a lawyer.

- Example: If an accident results in serious injuries or a fatality, the legal implications can be significant. In such cases, relying solely on BOLA might not be sufficient. Seeking legal counsel can help you understand your rights, navigate the legal complexities, and ensure you receive proper compensation.

Relies on Accurate Information

The effectiveness of BOLA hinges on the accuracy and completeness of the information provided by the parties involved. If there are discrepancies in the accounts or evidence is missing or tampered with, it can affect the liability assessment and the fairness of the settlement.

- Example: If one party provides a false account of the accident or withholds crucial evidence, it can distort the liability assessment and lead to an unfair outcome. It’s crucial to be honest and transparent when providing information to your insurer.

May Not Reflect the Full Picture

While BOLA considers typical accident scenarios, it may not account for all contributing factors or individual circumstances. For instance, it might not fully consider the actions of pedestrians, cyclists, or other road users who might have contributed to the accident.

- Example: Imagine an accident where a car swerves to avoid a pedestrian who suddenly crosses the road and ends up colliding with another vehicle. While BOLA might initially assign liability based on the collision between the two vehicles, it might not fully consider the pedestrian’s role in causing the accident.

Contesting a BOLA Decision in Singapore

While BOLA is designed to simplify liability assessment, there might be situations where you disagree with the insurer’s decision based on BOLA. In such cases, you have the right to contest the decision. Here are some options:

Negotiate with Your Insurer

Start by discussing your concerns with your insurer and presenting any evidence that supports your position. Insurers are often willing to review their assessment if you provide valid reasons and evidence.

File a Complaint with the FIDReC

If you’re unable to reach an agreement with your insurer, you can file a complaint with the Financial Industry Disputes Resolution Centre (FIDReC). FIDReC is an independent body that helps resolve disputes between financial institutions and consumers in Singapore.

Seek Legal Advice

In complex cases or if you believe there has been a significant error in applying BOLA, you might consider seeking legal advice. A lawyer can help you understand your rights and options and guide you through the process of contesting the decision.

For detailed insights, refer to this guide on Singapore’s Vehicle Safety Standards and Compliance, provided by the Land Transport Authority (LTA).

Your Guide to Understanding Car Accident Liability and Insurance Claims

The Barometer of Liability Agreement (BOLA) plays a vital role in simplifying and streamlining motor accident insurance claims in Singapore. Understanding how BOLA works can help you navigate the claims process more effectively and ensure you receive a fair settlement.

While BOLA provides a valuable framework, remember that accidents can have far-reaching consequences. Prioritize safety on the roads by following traffic rules, maintaining a safe distance, and being aware of your surroundings. And in case of an accident, seek the support you need to recover and rebuild.

As a leading personal accident insurance provider in Singapore, SG Accident specializes in helping individuals and their families recover from accidents, both physically and financially. We offer a range of comprehensive insurance plans designed to provide financial protection in case of accidents, covering medical expenses, rehabilitation costs, loss of income, and more.

What sets SG Accident apart is our unique offering of upfront cash incentives. Unlike traditional insurance claims, which can take time to process, we provide immediate financial support to help you with medical expenses, recovery costs, and other financial burdens. This can be a lifeline during a difficult time, allowing you to focus on your recovery without worrying about immediate financial pressures.

Our team of experienced professionals can guide you through the claims process, explain the implications of BOLA, and ensure you receive the support you deserve. We can also help you understand your coverage, gather necessary documentation, and negotiate with other parties involved to ensure you receive a fair settlement.

Also read: How to Make a Car Insurance Claim After a Road Accident in Singapore

Get Expert Help with Your Accident Insurance Claim in Singapore

Don’t face the aftermath of an accident alone. Contact SG Accident today to learn more about our personal accident insurance plans and how our unique upfront cash incentives can provide vital support when you need it most.