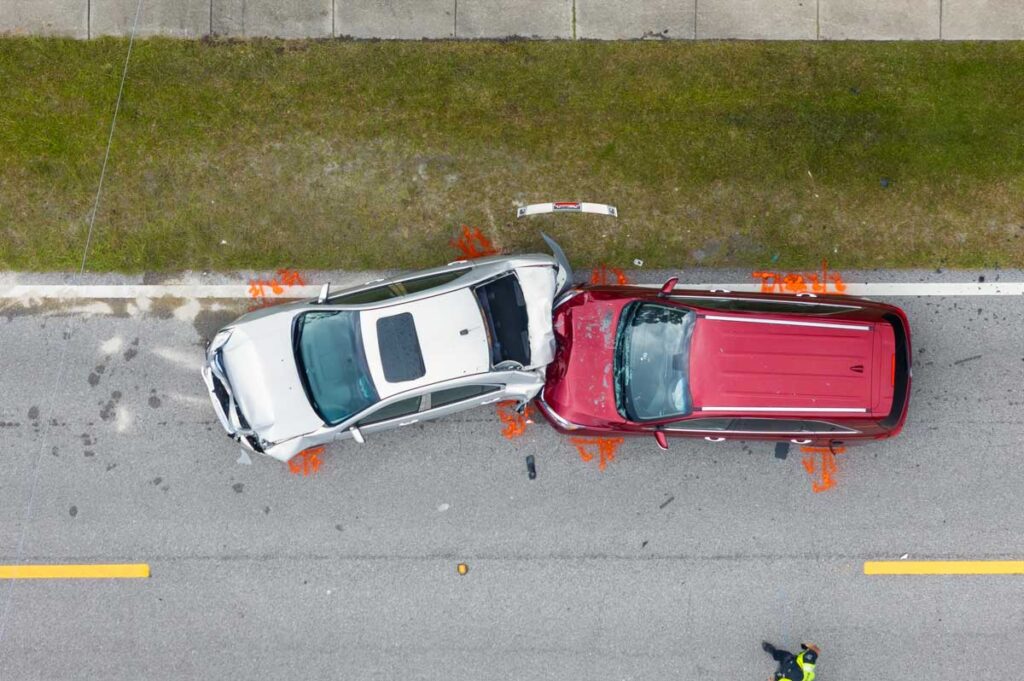

How Much Personal Injury Claim Singapore?

Personal injury accidents in Singapore can lead to significant financial burdens and emotional distress. Victims may be able to pursue a personal injury claim to seek compensation for medical expenses, loss of income, and pain and suffering. Factors such as the severity of injuries, liability, and medical expenses all influence the potential claim amount. It’s essential to gather evidence, keep detailed records, and seek legal advice from a personal injury lawyer in Singapore to address the claims process effectively.

How Much Personal Injury Claim Singapore? Read More »